The early bitcoin enthusiasts were trying to solve the problem of money being controlled by governments. Some governments found it laughable, others were just confused. But what if a government really embraced Bitcoin?

People of Iceland recently started an experiment with airdropped auroracoin, designed to counteract the government’s fiscal policy. Icelandic enthusiasts are attempting to bypass macro- and monetary policy. I would argue that there is another more tractable yet enormously valuable problem to solve.

The problem: handling money is slow and expensive

Making a local bank transfer in Europe costs somewhere between €0.20 and €0.40 all in. Most banks subsidise the cost of payments and take the money otherwise. Card payments are even more expensive, on average ~€0.45 for debit cards and €0.80 for credit cards.

The French central bank suggested that the cost of making payments on average is 1% of GDP. The Eurozone consumers are collectively bearing an €120bn annual cost burden just for moving money around.

This is a lucrative foodchain that we are keeping alive, starting from retail and merchant banks, clearing networks and card schemes like Visa and Mastercard. Paying off fraudsters, who take advantage of insecure technology. Finishing off with thousands of consultants and suppliers that keep it going.

Bitcoin 1.0 was not the solution

The noble idea that today’s bitcoin can one day be ether of the world’s financial transactions is nice but far fetched. Financial systems are about stability and predictability. No-one wants the value of their earthly belongings go up and down like a yo-yo.

What is clever about the cryptocurrency is the ability to transfer value securely and irrevocably. The innovation is in the blockchain. Bitcoin is a poor store of value, but a great medium of exchange.

And there is sufficient public attention – about 30,000 new people in the republic of internet get exposed to bitcoin every day.

Bitcoin 2.0 – the pegged currency

We are in an interesting place – on one hand there is a huge expensive burden of archaic banking and payment methods. On the other hand, the world has just discovered a dirt cheap, secure and decentralised way of making payments.

1. Fixed exchange rate

Imagine a cryptocurrency, where one token is always worth 1 Euro, regardless of what happens. Fixing an exhange rate is not difficult, you need someone to be the market maker, who always buys and sells at that fixed price.

Imagine we have a fork of bitcoin, lets call it eurocoin, which is pre-mined to say 50%. We create an issuing agency, who will always exchange 1 EUR -> 1 Eurocoin and backwards 1 Eurocoin -> 1 EUR. That issuer will keep the received EUR safe in cash or, at most, in bonds issued by the European Central Bank. The new currency will be 100% backed by real Euros.

If we allow the reserve Euros to be stored in government bonds, then the interest could be used to cover the maintenance cost of running this agency.

2. Mining for transaction fees

We want the new Eurocoin to be 100% backed by real currency. This means that the protocol should not allow for mining new Eurocoins to a meaningful extent, not to dilute Eurocoin against the reserve EUR. New coins could be mined possibly only to cover for the natural loss of coins.

The protocol would instead rely on transaction fees, a concept already built into the bitcoin protocol. Today transaction fees make up a smaller amount of mining revenue, currently running at ca 20 bitcoins = $10,000 per day. As the bitcoin supply will dry out around 2140, it is envisaged that the network is kept going on transaction fees alone.

Without going into the underlying maths, a fee of €0.001 – €0.003 per transaction should be sufficient to motivate miners to mine and have sufficient block frequency for transactions to clear quickly enough.

Interestingly, the current bitcoin protocol does not set an explicit fee, it is almost a voluntary reward for the miners to include the transaction in the block. Add more fees and get a faster confirmation on the transaction.

3. Anti money laundering

The reason why governments and traditional banks hate bitcoin, is because of the perceived anonymity. Although the bitcoin ledger is public at blockchain.info, the bitcoin addresses are anonymous and you cannot easily track who mined the money, where it went and who should pay taxes for revenue.

In order for Eurocoin to be serious, there has to be some visibility for the governments and law enforcement. Yet I’m not convinced that every single address and wallet has to be identified. As long as we identify the person, who owns the receiving wallet, when he converts real Euros to Eurocoins and all the sending wallets, when we convert back to Euros, we would be doing already better than we are today with cash. Similarly, people get identified when they take large amounts of cash out of a bank account and when they come in to a branch with a plastic bag filled with notes.

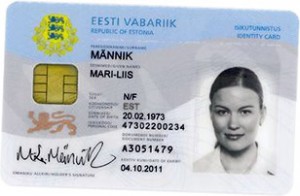

Our market-making Eurocoin exchange has to be responsible for identifying people, who convert Euros to Eurocoin and vice a versa. If you have something like a digital ID, then it can be totally frictionless.

All the tax regulations that apply to Euros should apply the same way to its crypto-brother. Some countries, like the U.S., are taking a step in the wrong direction here.

4. Spending it

Now we have the secure and trusted framework in place with a pegged currency, distributed blockchain and motivated miners, who are willing to verify transactions.

There are some obvious use cases for the government, where they can immediately start saving money and benefiting from that infrastructure. Just some ideas here, which can give a good starting distribution:

- collecting taxes and levies

- tax returns back to people

- ticketless bus and underground

- parking

- public service salaries/bonuses

In the end, governements are in a great place to make it into a law – public services and businesses at a certain size will have to accept the crypto-form of Euros as legal tender.

5. Open source banking

Here we just imagined a country open-souring its payments to a public blockchain and distributed miners, who keep the payments verified and secure. All that technology is already out there. The bitcoin mining software needs a bit of re-configuration to become Eurocoin. The country has to build a secure electronic vault, where they can keep its stash of pre-mined coins. The technology for accepting, keeping and paying with a cryptocurrency is out in the open source and anyone can adapt it for Eurocoin.

Utopia or not

There is a bold little country on the north-eastern edge of Europe, who has built itself up on innovation. Digital signature, ubiquitous ID implemented, the e-government should now take the next step.

There is a bold little country on the north-eastern edge of Europe, who has built itself up on innovation. Digital signature, ubiquitous ID implemented, the e-government should now take the next step.

Everyone already holds a bit of plastic and a SIM card, which contain your certified private keys and can do a bit of cryptocalculus. What if the next edition would also hold your keys to the national cryptocoin wallet.