Money is information. Using, storing, moving money should be as cheap and instant as exchanging information. As cheap as sending an email. And certainly it shouldn’t be more expensive or slower if the information crosses country borders.

That’s not the reality. World Bank calculates that people lose 7% on average on cross border, others triangulate the total fees banks charge be $200bn. With TransferWise we’ve brought the fees down to 0.3% on some routes, but we believe it can and should be much cheaper. We have made 27 price drops in the last 9 months and plan many many more. Here’s how we do it.

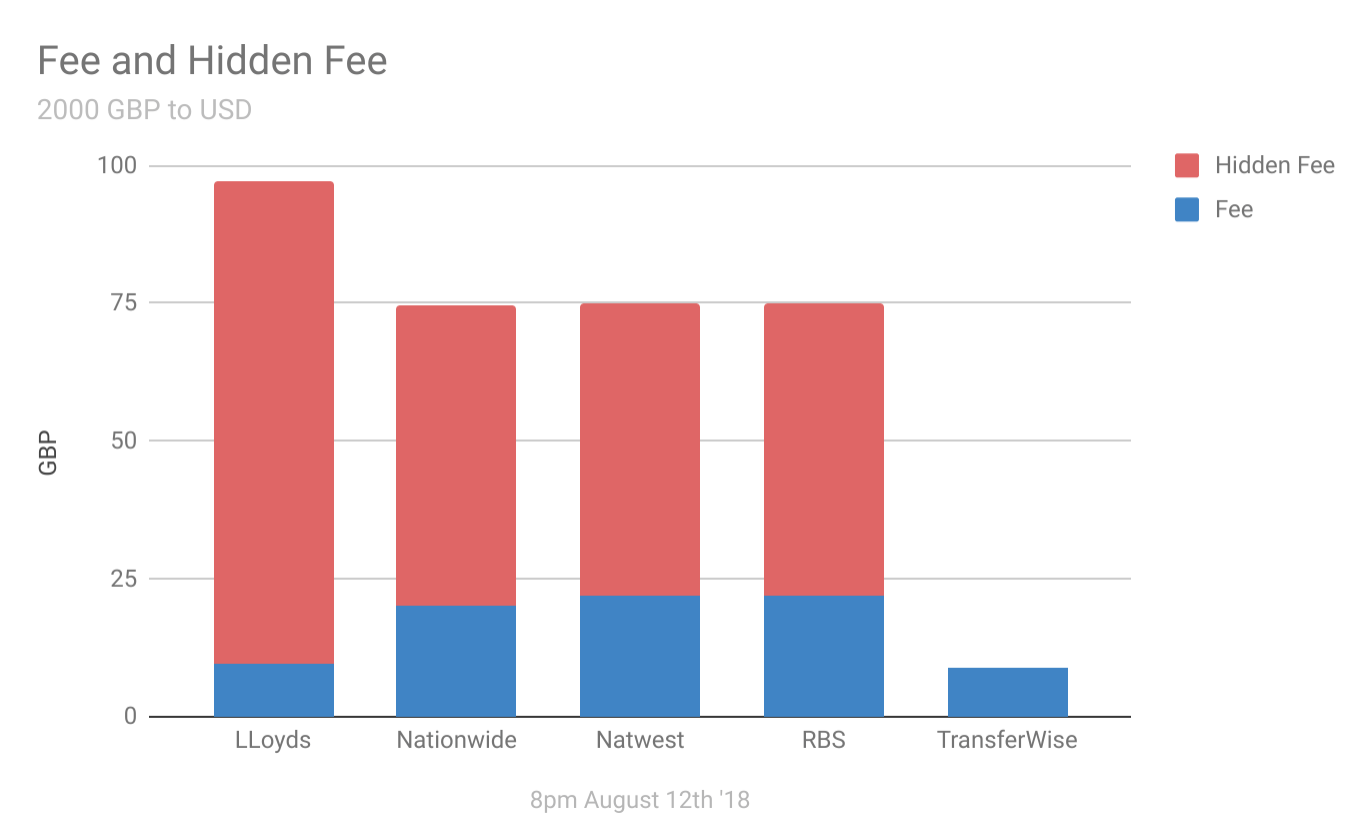

We are much proud about the progress we’ve made. Depending on the amount, it can easily be 8x cheaper to use TransferWise over your bank, who are hiding their fee in the exchange rate. We will eventually get the cost very close to zero and most transfers happen instantly. But why is it so hard – why does it still cost money to move money on TransferWise?

We are much proud about the progress we’ve made. Depending on the amount, it can easily be 8x cheaper to use TransferWise over your bank, who are hiding their fee in the exchange rate. We will eventually get the cost very close to zero and most transfers happen instantly. But why is it so hard – why does it still cost money to move money on TransferWise?

Why do we still have fees?

Firstly, it still costs us money to move money. Even 8 years later since we started working on it. There are direct costs related to moving money from your bank to us, making payouts in 56 countries and managing pools of currency across our network. A lot of the work we have automated, but many things we still need to do manually – whether that is operating payments, onboarding users or answering emails, calls and chats when users need help. Just to put it in context, we respond to 150,000+ user contacts every month. All the people doing this work make up our servicing cost.

Secondly, it costs money to make payments ever cheaper. That’s mostly our engineering and product-building investment. On our most efficient routes we invest nearly half of the fees back into product – into engineers, working on making payments faster, cheaper, more convenient.

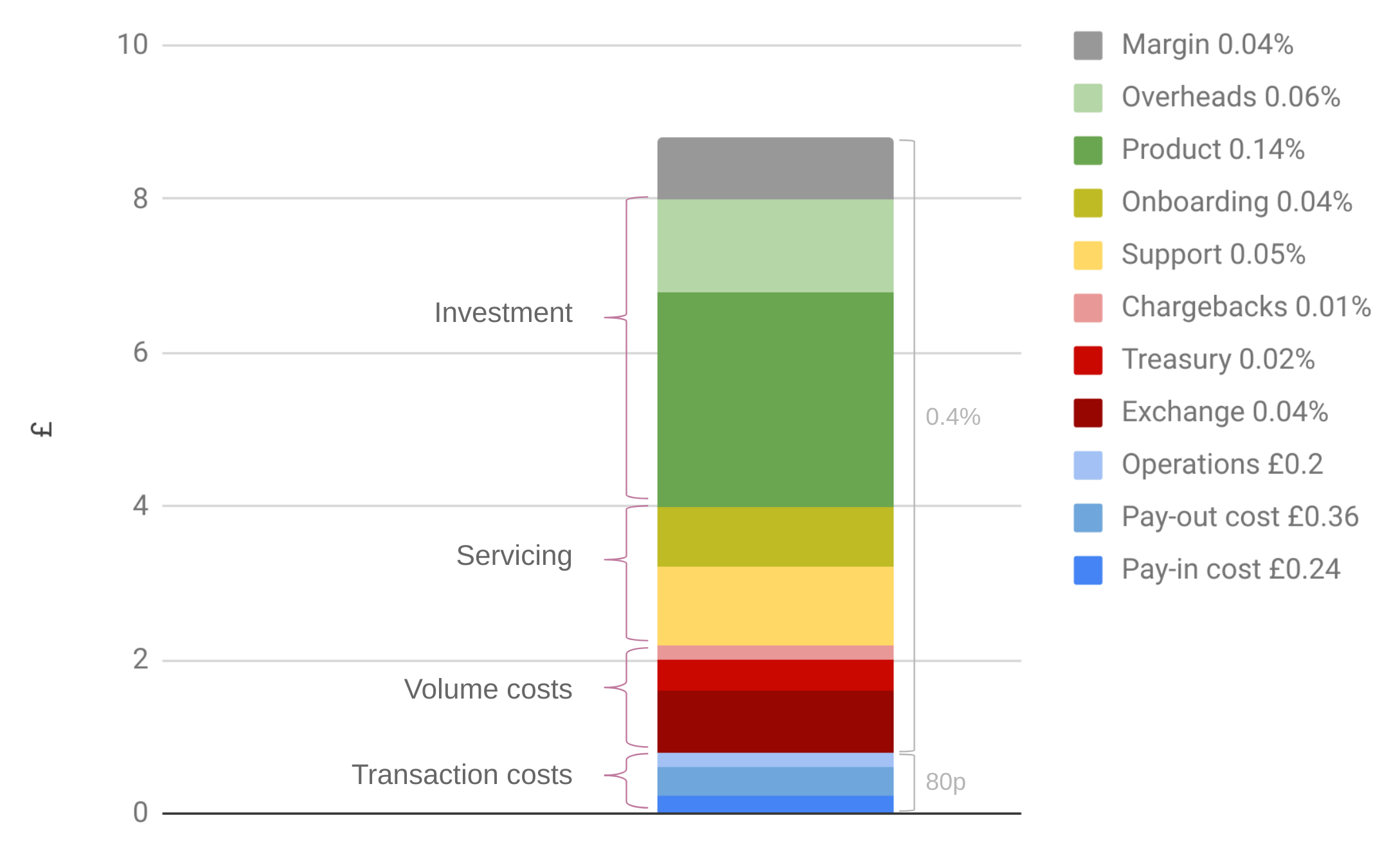

The big buckets of our costs split across these three groups:

- direct costs: transaction and volume based

- servicing costs

- investment

Here’s an example of a 2000 GBP transfer on one of our more efficient routes, with a fee calculated as 80p + 0.4%.

It is by design that the fees cover the costs, product investments plus leave a little margin. This margin today covers our spend on marketing and campaigning for transparency.

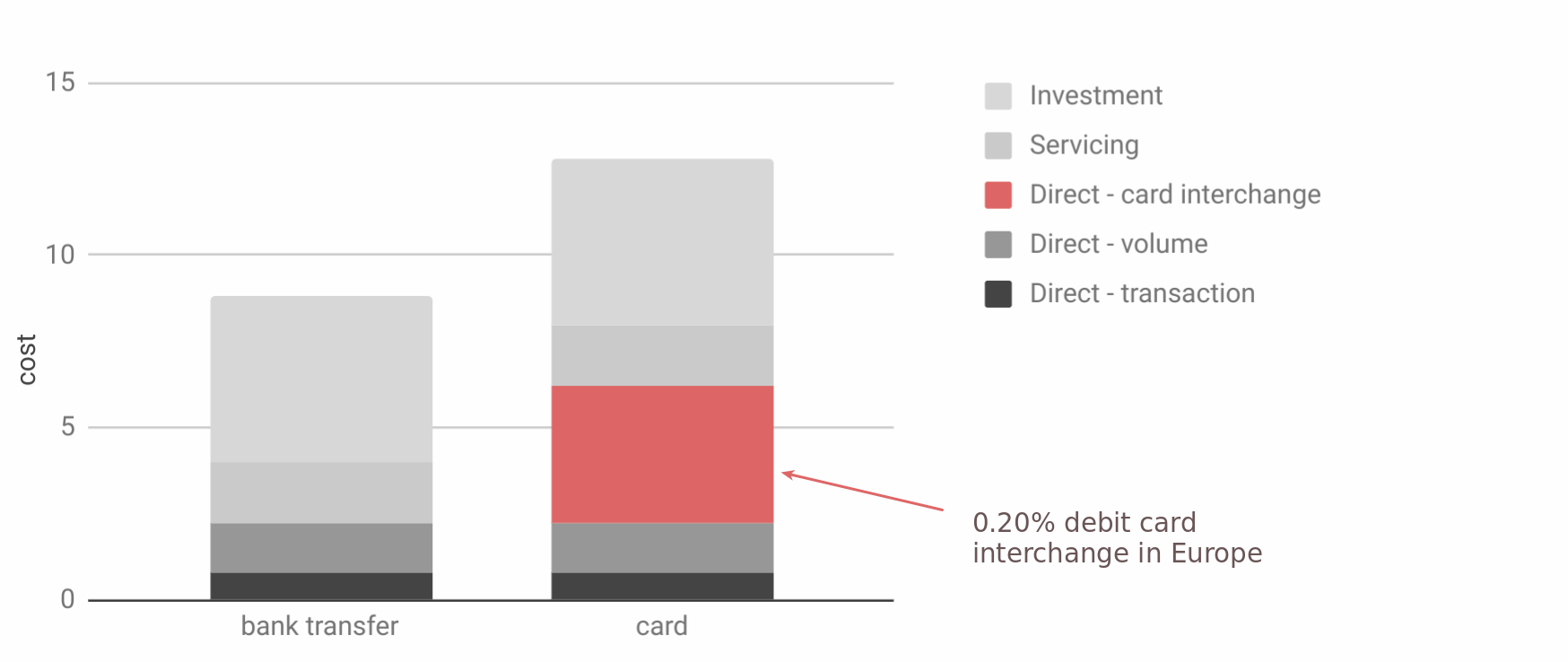

Card fees

Transfers from cards have different economics than the low cost bank-to-bank transfers. Card interchange charged by the card-issuing bank adds at least 0.2% to the cost and make the transfer 50% more expensive on the exact same route.

How can we make it cheaper?

As we got really anatomical with the costs, it became abundantly clear how we can get the cost of transfers down even closer to zero. Every part of the cost formula has its own solution.

Direct cost ~30%

Solution: competition. If you’ve ever tried negotiating fees with a bank you know it is a waste of time, until you have a competitive offer from another bank on the table. In most countries we’re connected to the local payment systems through multiple local banks. Partly to ensure our users can still make payments if one of the banks is down, but equally importantly to be able to negotiate the fees.

The only thing better than being able to choose between multiple banks is not having to rely on banks at all. When we started in the UK, the best I could negotiate with a commercial bank was a fee of £1.50 per payment. Since we’re directly connected to Bank of England and the payment network – this cost has gone down 50x.

Servicing cost ~20%

Solution: automation. In fact automating the manual processes and interactions with local banking systems is only part of the solution. The other part is building a product experience, which is so obvious that it doesn’t raise any questions. If the experience is clean, then users don’t get confused and they never need to call or email the support.

Investment ~50%

Solution: growth. Since 2011 we have always been searching for, interviewing, hiring and onboarding engineers. Every day, for 7 years and counting. Our product engineering team has grown to 300 people. It’s been crazy fast. But our volumes have grown much faster. As long as the growth of our volumes keeps outpacing the speed at which we can onboard new people, this investment naturally becomes a smaller proportion of transfer fees.

The biggest drivers are our users themselves – every person and a business they tell about their TransferWise experience will be a potential new user, bring more volume to the platform and make the costs cheaper for everyone.

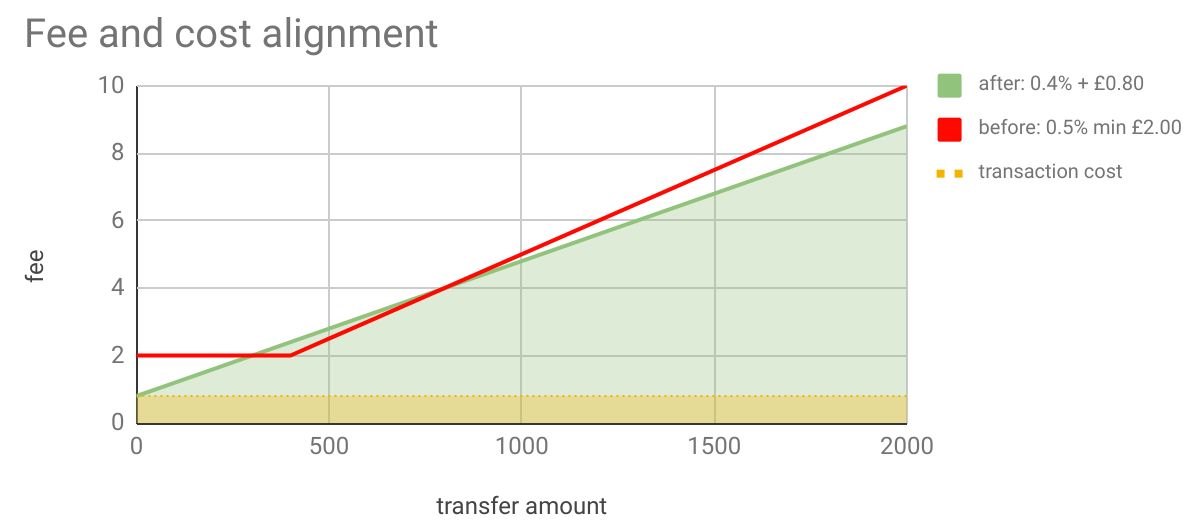

Cost structure: transactions + volume

We set our prices first in 2011 to be at 0.5% and also set a minimum, e.g. £2.00 to make sure we cover the transaction costs. It turned out our costs had no “minimum”, but were rather made up a fixed cost per transaction and cost per volume. Therefore the correct formula is something more like: 0.4% + 80p.

With the first round of price changes we changed from minimum fees to transaction fees. It has the positive effect of making small payments under £400 and large payments cheaper, but also a negative effect for people transferring between £400 and £800. A lot of transfers fell into that £400-£800 bracket and for many users we first had to bring bad news due to that correction.

The principles of a price mission

Money without borders – instant, convenient, transparent and eventually free. We’re powering money for people and businesses: to pay, to get paid, to spend, in any currency, wherever you are, whatever you’re doing.

While working towards our mission zero, we have understood some guiding principles that make it easier for us to drop fees. In order to achieve mission 0, we need to get to mission 0.1% and even before that to mission 0.2%. We have just reached 0.3% on some routes, the road ahead is clear.

We have worked out a few guiding principles for ourselves

- Don’t cross-subsidise.

- Don’t cross-subsidise currency routes. We operate 1400 currency routes and it is much cheaper to move money between USD, GBP, EUR than for example from Brazil to Kenya. If we want every route to be as cheap as possible, they cannot subsidise other routes.

- Don’t cross-subsidise payment methods. Our users send money from bank accounts and usually there is a low cost option of a bank transfer and a faster, more convenient option of debit cards.

- Don’t compete. If another team outside TransferWise has figured out how to make a route cheaper than us, then we should learn from them. But until then, we should recommend our users to use this other provider.

- Align structure to cost. The costs are by transaction + % volume, so should be the fees.

- Agree rules, so we can execute fast. We have agreed a formulaic mechanism across the organisation, which looks at our last few months costs on the routes and determines if we can reduce our prices.

Following these guidelines we have become very exact in the pricing. Every route has their own price and their own journey towards zero. Recently one of our first investors Jesse Beyroutey shared his thinking on why does it make sense to fund this price lowering mission.

Progress to date

In the last 9 months we’ve made 27 price drops and changed fees on all of our 1400 routes. For the vast majority of routes, there is now a cheaper option than before – often 2x cheaper. Here’s just one example:

This is one of the reasons Transferwise is one of Europe’s most impressive and fastest growing tech companies. How often do you get an email advising you of a price drop? The close is also brilliant “As soon as we can bring our fees down again, we’ll let you know.” #FinTech pic.twitter.com/gjvFzHXVYK

— Alan Gleeson (@AlanGleeson) June 28, 2018

Here’s a selection of recent price changes:

- 🇬🇧 GBP – Oct ’17. For the first time we broke below the 0.5% fee and priced GBP to EUR at 0.35%.

- 🇺🇸 USD – Jan ’18. We brought the most efficient routes down to 0.6% for wire transfers, direct ACH debits to 0.75%. Moving money in the US is expensive.

- 🇦🇺 AUD, NZD – Feb ’18. Many routes came down from 0.7% to 0.45%.

- SGD, JPY, HKD – Mar ’18.

- 🇸🇬 SGD – Apr ’18. We reduced our prices the second time. Almost every route and every amount got a price reduction.

- 🇧🇷 BRL – Apr ’18. Brazil is the most expensive country to send money from, complicated by the funds expatriation tax “IOF”. Although we managed to reduce our cost, at the same time the Brazil government increased the tax. The increase cancelled out most of the benefit to users.

- 🇨🇦 CAD – May ’18. Most efficient routes came down to 0.6%.

- 🇭🇰 HKD – May ’18. Reduced fees for biggest routes for the second time.

- CHF, HUF, PLN, BGN, RON, CZK, HRK, SEK, NOK, DKK – Jun ’18. We changed prices on 460 currency routes simultaneously. First time achieved 0.3% on a route, eg CHF to EUR.

- 🇪🇺 EUR – Jul ’18. Most European routes came from 0.5% to 0.3% .. 0.4%.

What’s next?

More price drops. We have two goals – we’ve shown that 0.3% is sustainably possible on some routes – how can we now get most of the worlds’ routes onto 0.3%. The next challenge is 0.2% 🙂

Our mission remains to make money move cross borders eventually for free. The path there takes us to 0.3% then to 0.2% and then to 0.1%.