Card payments above £250 got more expensive in the UK today. Visa, who operates 98% of the debit cards in the country raised the fees paid to the banks who give us these bits of plastic. Why?

A few months ago I was on a panel on Chancery Lane, organised by the financial regulator. The topic was how should regulation shape innovation. My co-panelist was a gentleman working for American Express, who opened with explaining how regulators need to be more mindful of changes and consult the industry before deciding policy. “By capping card fees, regulators have destroyed billions of dollars of value in the card industry over the last years,” he was referring to the European Commission rules which limit what card networks can charge as interchange.

Interchange fee is a nasty, yet necessary construct, which refers to money charged from the merchant and given to the card issuing bank, to incentivise banks to issue cards to people and cover the cost of debiting money from their accounts.

For example, when you buy £200 designer lingerie at my wife’s shop paying with a Lloyds debit card, she pays £6.8 of that to PayPal in card fees, of which 40p goes to Lloyds, who issued your card. This 40p is called interchange.

I was initially struck by the arrogance of my co-panelist, but then realised that he really didn’t understand what he had just said. It only takes a few seconds to pause and internalise that these billions of pounds destroyed in card industry were in fact just given back to the shopkeepers, cafe owners and people paying with cards. All these ordinary people had a few billions more to spend on nicer dinners, longer holidays, sending kids to better schools.

Competition is for wimps

What is the real cost of a card payment? Australian regulators figured it can’t be more than 8¢. “That should have enough profit margin for banks to be happy to issue cards,” they thought. Card payments work beautifully in Australia, no issues at all. I almost feel it is unfair to the aussie banks who only get 8¢ on a £1000 payment, while their UK peers happily collect £2 on the same payment. While aussie banks might get a meager 25% profit margin, the banks here must take home 97% of this fee.

Interchange is nasty because it is neutral to competition and market forces, which would normally drive costs down. Merchants hate card fees with a passion, but they love to get paid – they have to take the card that the customer gives them. There is no incentive for you as the buyer to choose a different card or a different bank – you don’t even know how much your bank charges your friendly barista to get your money.

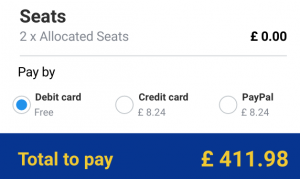

Credit cards +£3.50

Most Europeans first got a glimpse into card fees and the concept of surcharge thanks to Easyjet and Ryanair, who figured they don’t need to raise prices of flights for everyone, but keep the prices low for folks paying with debit cards. I personally know many people who got their first debit cards purely for paying for flights on these websites.

Most Europeans first got a glimpse into card fees and the concept of surcharge thanks to Easyjet and Ryanair, who figured they don’t need to raise prices of flights for everyone, but keep the prices low for folks paying with debit cards. I personally know many people who got their first debit cards purely for paying for flights on these websites.

You think banks liked it? Oh no. In many countries the card networks require merchants to sign a paper, which says they cannot pass card fees on to customers. Eg paying with cards can’t be more expensive than paying cash. Australian regulators decided this is definitely not helping competition, they decided to make such terms illegal.

Is there a happy future?

So why did Visa and the banks raise card usage fees today? Because they could. Our money lives in banks. Practically they decide if and how we get to use it and how much it is going to cost. Either we keep slapping their greedy little fingers like my favourite Australian regulators or we invent a world where our money doesn’t live in banks.

Full text of the conclusions (pdf) of the interchange study by the Reserve bank of Australia.